Ministry & Church Consulting Clergytech

Church payroll management can be complicated due to the regulatory burdens placed on nonprofits and charitable organizations. Withholding works differently Food Truck Accounting for ministers, employees, and independent contractors. However, specialized software and training can help address these unique challenges and achieve more effective church payroll management. The platform is a great choice for modern churches because it enables you to set your employees up with benefits and manage paid time off.

We’re experts in helping churches and ministries start up –and then grow up.

- The software program can quickly adapt to any business, including nonprofits and churches.

- As the name suggests, MinistryWorks caters to churches, religious schools and other spiritual organizations that are looking for software that accounts for ministry-specific tax laws.

- However, it doesn’t assign dedicated church payroll specialists to its clients like MinistryWorks does.

- Book a call with one of our experts today to start a conversation about getting your church’s payroll tax compliant.

- You can enter employee hours, set up and update hourly rates, and calculate deductions.

- Much like QuickBooks and Gusto, this software supports unlimited and automatic pay runs.

Whether you need help creating a payroll plan, entering employee information, or handling workers’ compensation, payroll software for churches can handle it all. This article explores 7 of the best software options that offer unparalleled church payroll services. We offer payroll compliance reviews and corrections of past payroll reports to cut down on penalties and interest, and limit your risk of losing tax exempt status. While many payroll services process church payrolls, they’re often not aware of the special withholding and reporting rules and laws for ministers and other church employees. This service is provided on a case-by-case basis, so please contact us for a consultation and quote.

Tax calculations and deductions

When it comes to setting up payroll for your church or retained earnings balance sheet religious organization, you’ll basically follow the same 5 steps as any other entity would take. Book a call with one of our experts today to start a conversation about getting your church’s payroll tax compliant. Parable is a team of mission-minded professionals who understand the difficulties of church financial stewardship.

Step 5: Use a payroll platform for your church

- If you upgrade to higher tiers, you get additional features like time tracking and a tax penalty protection that covers filing errors that you or its representatives make.

- National Association of Church Business Administration offers insights into efficient financial management.

- If your church pays musicians to perform during services or other events, you’ll need to determine if they are employees or independent contractors.

- It even comes with workflows you can customize, enabling you to further streamline employee management tasks.

That said, some churches add 7.65% to their pastors’ paychecks to cover half of SECA. Rippling also offers PEO services for employers that need to manage and administer smaller organizations. You pick and choose which modules you need to create your own customized plan. MinistryWorks has a unique pricing structure that charges organizations per payroll run, not per month or per employee.

- That includes any salary or fees for things like performing marriages, funerals, and baptisms.

- If you don’t do this, the IRS will see the housing allowance as taxable income.

- The reporting features, HR functionality, and price make this one of the most flexible church payroll services.

- This payroll software has 6 permission levels, so you can do payroll tasks and delegate HR and payroll tasks as you see fit.

- At REACHRIGHT, we understand the unique challenges busy churches and ministries face when it comes to online marketing.

Whether you’re new to payroll systems, want to upgrade your existing one, or need help with local tax payments, the solutions in this article can help. Users can set tax exemptions for exempt employees, such as ministers. The software integrates with the nonprofit accounting software program Aplos, which tracks payroll automatically for nonprofit organizations and churches. After reading this article, you’ll have the information you need to set up accurate and compliant church payroll so you can focus your time and energy on furthering your mission.

Direct deposit

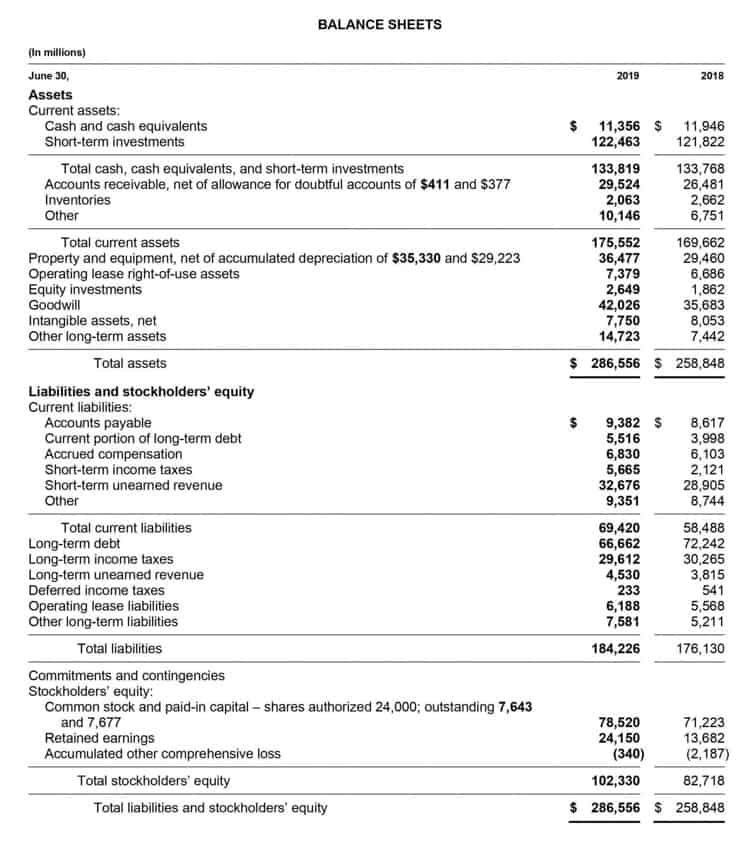

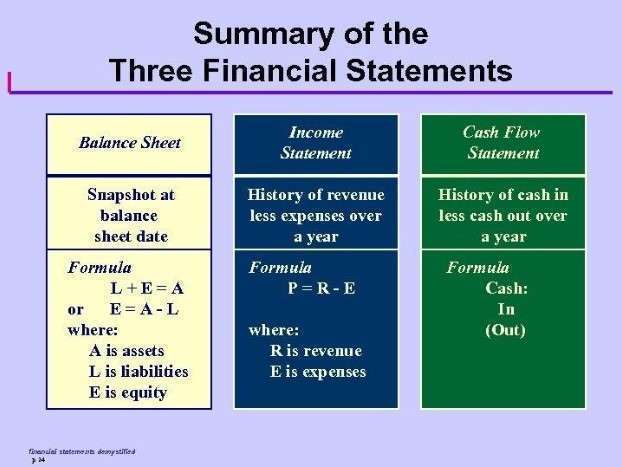

You withhold income tax and FICA for your church’s employees who are not ministers. Payroll for churches involves understanding the tax implications of being a minister, non-clergy employee, contractor, and volunteer. You must compensate each properly, knowing church payroll the rules behind a pastor’s dual tax status and housing allowance. ADP RUN offers four pricing plans — Essential, Enhanced, Complete and HR Pro — but doesn’t actually disclose pricing for any of them. ADP also widely advertises its three months of payroll deal, but the fine print on the offer says you must sign a sales order to get the deal, so it’s not really a true free trial. The frequency can depend on the size of your church and your payroll team.